A weighted average is a way of taking the average of several numbers when a different “weight” is assigned to each one. A common example of a weighted average is calculating a grade point average for courses with different numbers of credit hours. Below is the Weighted Average Shares calculation example when shares are issued and repurchased during the year. Those with complex structures, including potential dilutive securities, must report both basic EPS and diluted EPS. The weighted average is a mean value calculated by averaging each quantity against an assigned weighting to determine the relative importance of each quantity. Below is a break down of subject weightings in the FMVA® financial analyst program.

WASO in the Real World: Implications and Applications

Halfway through the year, it issues new shares in the amount of an additional 100,000 shares. Click the “Calculate Weighted Average” button, which will display the total days, ending shares, and weighted average. The results will also include a printable period-by-period chart showing how the weighted average was computed. In this example, the weights are calculated as 0.75 and 0.25, respectively, and the weighted average number of shares outstanding is 131,250.

To Ensure One Vote Per Person, Please Include the Following Info

- Group 2 consists of the 8,000 shares outstanding from 1 April to the end of the year and group 3 is the 12,000 shares outstanding from 1 April to 31 August.

- If no data record is selected, or you have no entries stored for this calculator, the line will display “None”.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

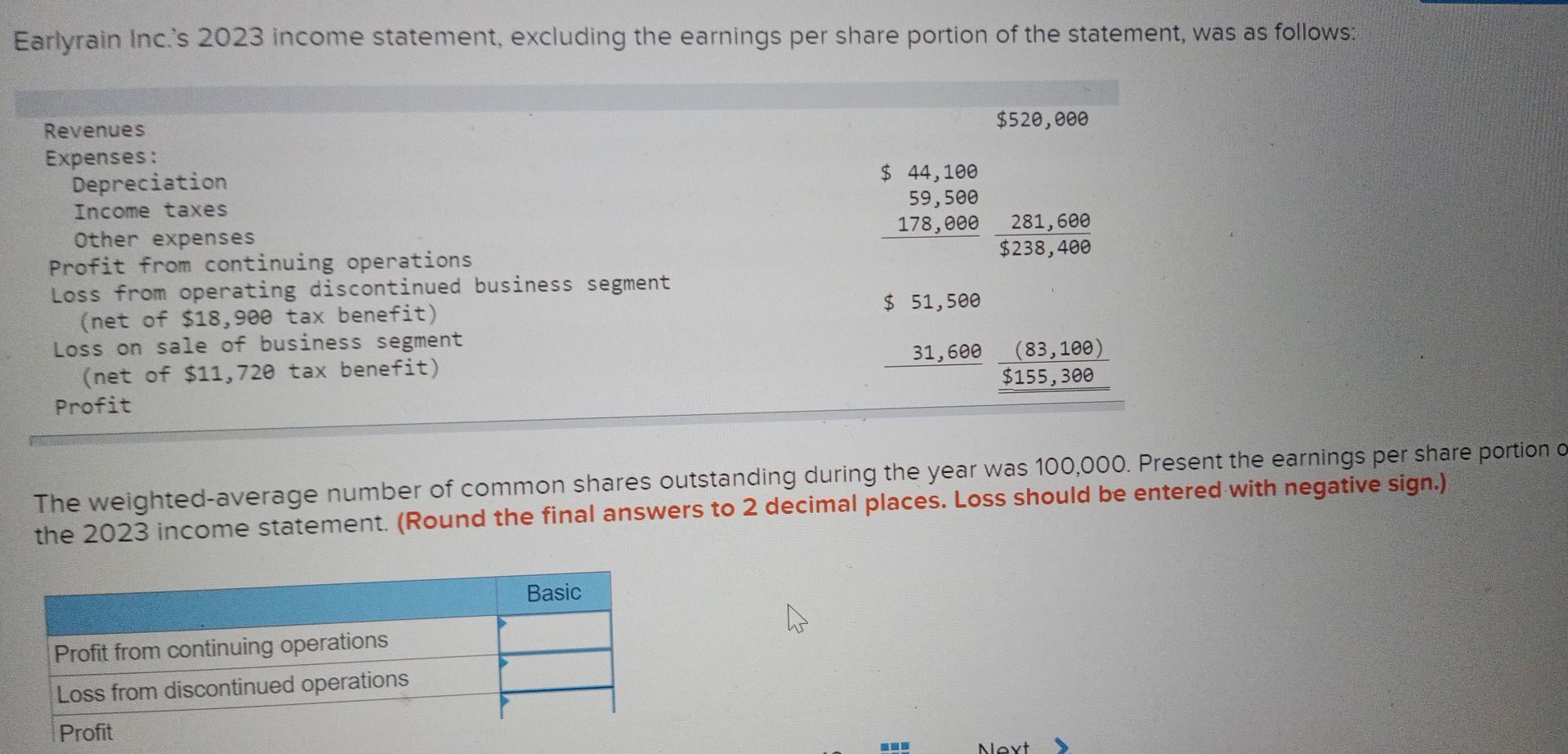

- WASO’s primary application is in calculating EPS, a key indicator of a company’s profitability on a per-share basis.

- In case there is a large difference between basic and diluted EPS, investors should be aware of the possible increase in the number of shares outstanding in the future.

- The following results from the calculator on this page show how the weighted average calculation more accurately reflects the day-to-day average of outstanding shares.

A weighted average is simply a method of determining the mean of a set of data in which certain points occur multiple times or in which certain points are valued more highly than others. Though the method of determining weights may vary, weighted averages are used in the calculation of a variety of technical indicators and financial metrics. WASO’s primary application is in calculating standard deduction EPS, a key indicator of a company’s profitability on a per-share basis. It’s crucial for investors who utilize EPS to compare companies’ financial health. An increasing WASO might dilute EPS, potentially affecting investor perceptions and company valuations. Start by segmenting the reporting period into intervals where the number of outstanding shares remained constant.

Additional Resources

The weighted average number of shares is determined by taking the number of outstanding shares and multiplying it by the percentage of the reporting period for which that number applies for each period. In other words, the formula takes the number of shares outstanding during each month weighted by the number of months that those shares were outstanding. Because investors frequently purchase shares of a company at various times and in various amounts as they build their position in a stock, it can be a challenge to keep track of the cost basis of those shares.

Suppose that Company XYZ Corporation has 500,000 shares at the beginning of its fiscal year. At the beginning of the second quarter, debenture holders of the company decided to convert their holdings into equity shares totaling 100,000 shares. At the beginning of the fourth quarter, the company buys back 50,000 shares with its cash surplus.

Group 2 consists of the 8,000 shares outstanding from 1 April to the end of the year and group 3 is the 12,000 shares outstanding from 1 April to 31 August. The weighting of each group by the fraction of the year it was outstanding is shown below. Thus, the denominator is expressed in terms of the type of common share that exists at the time the financial statements are released, rather than the type that exists when the earnings were achieved. With this weighted average, we can now calculate a different and more accurate EPS of $0.80 per share. Let there be a Company A that has 100 thousand shares outstanding at the start of the year, i.e., 1 January.

As noted above, outstanding shares are used to determine very important financial metrics for public companies. These include a company’s market capitalization, such as market capitalization, earnings per share (EPS), and cash flow per share (CFPS). The term outstanding shares refers to a company’s stock currently held by all its shareholders.

Note that the Help and Tools panel will be hidden when the calculator is too wide to fit both on the screen. Moving the slider to the left will bring the instructions and tools panel back into view. Clicking the “Reset” button will restore the calculator to its default settings. Follow me on any of the social media sites below and be among the first to get a sneak peek at the newest and coolest calculators that are being added or updated each month. I promise not to share your email address with anyone, and will only use it to send the monthly update. If it’s not filled in, please enter the title of the calculator as listed at the top of the page.